In the dynamic landscape of modern banking, institutions constantly strive to redefine their approach to meet the evolving needs of customers. At the forefront of this transformative journey is HDFC Bank, a financial powerhouse that has not only established itself as a leader in the industry but has also pioneered innovative strategies to embrace the digital era.

As we delve into the digitization of brands, HDFC Bank emerges as a compelling case study, showcasing how this financial giant navigates the intricate intersection of technology and finance. Against the backdrop of a rapidly changing banking sector, the significance of digitization cannot be overstated, and HDFC Bank’s strategic initiatives serve as a beacon illuminating the path towards a more interconnected and tech-savvy financial future.

This case study unravels the pivotal role played by HDFC Bank in leveraging digitization to not only stay competitive but also to redefine the very essence of banking in the 21st century.

Background of HDFC Bank

HDFC Bank, established in 1994, emerged as a significant player in India’s banking landscape. Founded by Housing Development Finance Corporation Limited (HDFC), the bank rapidly gained prominence for its commitment to customer-centric services and innovative financial solutions. Over the years, HDFC Bank has not only weathered economic fluctuations but has also consistently expanded its footprint, establishing itself as one of India’s leading private sector banks.

HDFC Bank adhered to conventional banking practices, emphasizing physical branch networks and in-person transactions. The bank prioritized building relationships with customers through personalized services, an approach that was reflective of the prevailing banking norms.

Recognizing the evolving landscape and the growing impact of technology, HDFC Bank took early strides towards digital transformation. Investments in core banking systems, ATMs, and online banking platforms marked the initial foray into the digital realm. This phase laid the foundation for the bank’s subsequent endeavors to integrate cutting-edge technology seamlessly into its operations.

Need for Digitization

As customer expectations underwent a paradigm shift, demanding instant access, and personalized services, HDFC Bank responded proactively. The demand for banking services that transcended geographical constraints and time zones fueled the need for digital solutions that could cater to the modern customer’s fast-paced lifestyle.

To maintain its leadership position, the bank strategically embraced digitization to enhance operational efficiency, provide innovative financial products, and stay attuned to the evolving preferences of its customer base.

Regulatory Environment and Compliance

In a regulatory landscape that increasingly emphasized the importance of secure and transparent financial transactions, HDFC Bank embraced digitization as a means to ensure compliance. The bank invested in robust cybersecurity measures and adhered to evolving regulations, viewing digitization not only as a strategic move but also as a responsible commitment to regulatory standards.

HDFC Bank’s Digitization Strategy

HDFC Bank articulated a robust vision and mission for digital transformation, envisioning a future where cutting-edge technology seamlessly integrates with financial services to deliver unparalleled convenience, accessibility, and innovation to customers.

Investment in Technology and Infrastructure

HDFC Bank made substantial investments in upgrading its technological infrastructure. This involved the adoption of advanced core banking systems, cloud computing, and cybersecurity measures to ensure a secure and scalable foundation for its digital initiatives. The bank’s commitment to staying at the forefront of technological advancements underpins its strategy for sustainable digital growth.

Partnerships and Collaborations to Enhance Digital Capabilities

HDFC Bank strategically engaged in partnerships and collaborations to amplify its digital capabilities. Collaborating with FinTech firms, technology innovators, and other industry players allowed the bank to leverage external expertise, access cutting-edge solutions, and foster an ecosystem that promotes continuous digital innovation.

Key Digital Initiatives

HDFC Bank’s multifaceted digitization strategy reflects a holistic approach towards leveraging technology to enhance every facet of the banking experience, from transactional convenience to customer support and financial innovation. As we delve deeper into the outcomes of these initiatives, a comprehensive understanding of HDFC Bank’s digital prowess emerges.

Online Banking Platforms

Internet Banking : HDFC Bank’s internet banking platform serves as a cornerstone of its digital strategy, offering customers a comprehensive suite of online services. From account management to fund transfers and bill payments, the internet banking portal provides a user-friendly interface, empowering customers to conduct financial transactions at their convenience.

Mobile Banking Applications : The bank’s mobile banking applications extend the digital experience to users’ fingertips. With intuitive interfaces, real-time notifications, and features such as mobile check deposits, HDFC Bank’s mobile apps cater to the on-the-go lifestyle of modern customers, ensuring seamless and secure access to banking services.

Digital Payment Solutions

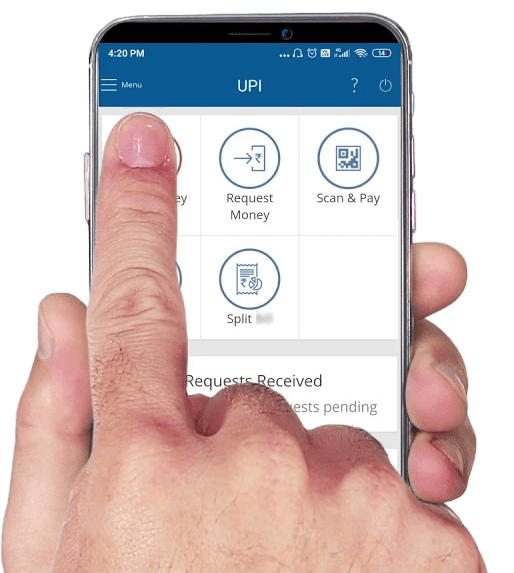

UPI (Unified Payments Interface) : HDFC Bank embraced UPI, revolutionizing peer-to-peer transactions and merchant payments. The bank’s integration with UPI allowed customers to make instant, secure, and interoperable transactions, contributing to the broader goal of promoting a cashless economy.

Digital Wallets : Through the development and promotion of digital wallets, HDFC Bank diversified its digital payment options. These wallets, integrated into the bank’s ecosystem, offer users a convenient and secure way to make payments, both online and offline.

Customer Service through Digital Channels

Chatbots and Virtual Assistants : HDFC Bank deployed advanced chatbots and virtual assistants to enhance customer service. These AI-powered tools provide instant support, answer queries, and guide customers through various processes, contributing to an efficient and responsive customer service experience.

Social Media Engagement : Recognizing the importance of social media as a customer engagement platform, HDFC Bank leveraged social channels for communication, support, and feedback. Social media engagement became an integral part of the bank’s strategy to connect with customers and address their concerns in real-time.

Impact on Customer Experience

As HDFC Bank navigates these challenges, the impact on customer experience remains a dynamic interplay of advancements, adaptations, and ongoing efforts to create a digital ecosystem that not only meets but exceeds customer expectations. The lessons learned from addressing these challenges contribute to the bank’s continued evolution in the digital space.

Enhanced Accessibility and Convenience

HDFC Bank’s digitization efforts have significantly elevated the accessibility and convenience offered to its customers. Through online banking platforms and mobile applications, customers now enjoy 24/7 access to their accounts, enabling them to conduct transactions, check balances, and manage finances at their convenience. This heightened accessibility has not only streamlined routine banking activities but has also eliminated geographical barriers, ensuring a seamless banking experience for customers across diverse locations.

Personalized Services through Data Analytics

Harnessing the power of data analytics, HDFC Bank has tailored its services to individual customer preferences and behaviors. By analyzing customer data, the bank can offer personalized financial recommendations, product suggestions, and targeted promotional offers.

Improved Communication and Engagement

Digitization has transformed the communication landscape between HDFC Bank and its customers. Real-time notifications, updates, and interactive features within digital platforms enable proactive communication. Moreover, the integration of social media channels has provided customers with additional avenues to engage with the bank, seek assistance, and share feedback.

Challenges Faced

Technological Challenges

Despite the strides in digitization, HDFC Bank has encountered various technological challenges. Keeping up with the rapid pace of technological advancements, ensuring seamless integration of diverse digital channels, and adapting to emerging platforms pose ongoing challenges. The bank continually invests in technology upgrades to address these challenges and stay at the forefront of the digital banking landscape.

Cybersecurity Concerns

As digital channels become integral to banking operations, the risk of cybersecurity threats amplifies. HDFC Bank faces the constant challenge of safeguarding customer data, financial transactions, and the overall integrity of its digital infrastructure. Implementing robust cybersecurity measures and staying vigilant against evolving threats are paramount to maintaining customer trust and data security.

Adoption Challenges

The diverse demographic profile of HDFC Bank’s customer base presents a challenge in ensuring universal adoption of digital services. While younger generations readily embrace digital banking, older segments may exhibit resistance or limited familiarity with technological interfaces.

Conclusion

HDFC Bank’s embrace of digitization has redefined the banking experience, marked by enhanced accessibility, personalized services, and improved communication. Despite facing technological challenges, cybersecurity concerns, and the need to bridge adoption gaps, the bank’s proactive approach positions it as a trailblazer in digital banking. As HDFC Bank continues to innovate, its success serves as a valuable lesson for the industry, emphasizing the transformative impact of technology on modern finance.

Looking for a smart digital marketing plan for your business? We’ve got you covered with a range of effective marketing services. Check out our website today!

All images belong to their respective owners. Please email [email protected] if removal is required.