Every successful organization relies on managing money well. Having accurate financial information, smooth processes, and making smart decisions are crucial for any business that wants to grow and last. In today’s digital age, businesses face more complicated money challenges, like handling transactions in different currencies and following rules and regulations.

That’s where ERP (Enterprise Resource Planning) systems come in — they’re like a big change-maker in how businesses handle their money. In this easy-to-follow guide, we’ll explore how using an ERP system can completely transform the way your organization deals with its finances. Whether you’re a small startup trying to make your money management simpler or a big company wanting better control over your finances, this article will show you how ERP systems can make a big difference.

Key Challenges in Financial Reporting and Compliance

Financial reporting and compliance pose significant challenges for businesses, affecting their overall operations. Understanding the key issues in this realm is crucial for organizations striving for accurate and timely financial management. Here’s an overview of common challenges and their impact on business operations:

Data Accuracy and Consistency

- Ensuring the accuracy and consistency of financial data is a common challenge, often stemming from disparate systems and manual data entry.

- Inaccurate data can lead to faulty financial reports, hindering the ability to make informed decisions. It may also result in compliance issues due to reporting errors.

Regulatory Compliance

- Staying compliant with ever-evolving financial regulations is a continuous struggle, especially for businesses operating in multiple jurisdictions.

- Non-compliance can result in legal consequences, fines, and damage to the company’s reputation. Adhering to complex regulations requires substantial resources and expertise.

Timeliness of Reporting

- Delays in financial reporting can occur due to manual processes, inefficient systems, or a lack of standardized reporting practices.

- Untimely financial reporting can hinder decision-making, affect stakeholder confidence, and lead to missed opportunities. Compliance deadlines may also be at risk.

Security and Data Privacy

- Safeguarding financial data from unauthorized access and ensuring compliance with data privacy regulations present ongoing challenges.

- Data breaches can lead to financial losses, reputational damage, and legal ramifications. Adhering to data privacy laws is crucial for maintaining trust with clients and partners.

Complexity in Consolidation

- Consolidating financial data from diverse sources, especially in large organizations or those with global operations, can be intricate.

- Difficulty in consolidating data may lead to errors in financial statements, affecting the reliability of financial information and potentially causing compliance issues.

Audit Trail and Documentation

- Maintaining a clear audit trail and comprehensive documentation of financial transactions is essential but can be challenging.

- Inadequate documentation can raise concerns during audits, leading to increased scrutiny and potential compliance issues.

Technological Integration

- Integrating financial systems with other business applications and emerging technologies can be complex.

- Inefficient integration hampers the ability to leverage technological advancements, hindering overall financial efficiency and agility.

Role of ERP in Financial Management

ERPs bring together diverse functionalities into a unified system, facilitating a holistic view of an organization’s financial landscape. This integration not only promotes efficiency but also enhances the accuracy and reliability of financial data.

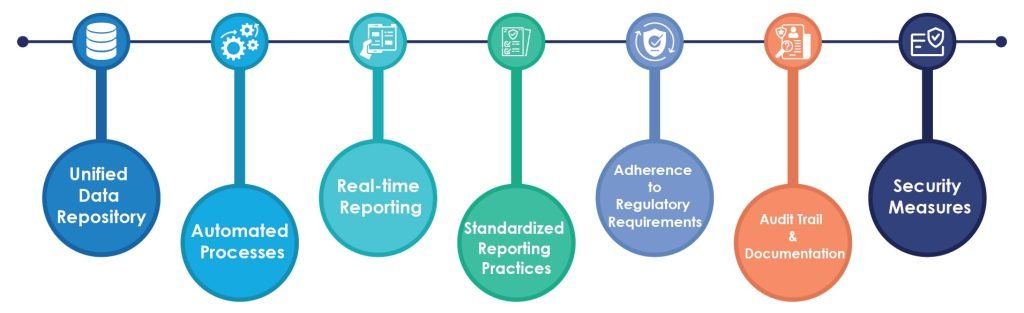

How ERP Addresses Reporting and Compliance Challenges:

Unified Data Repository

Integration of Financial Data: ERP systems consolidate financial data from various sources into a single, centralized repository. This integration ensures data consistency and accuracy, reducing the likelihood of errors in financial reporting.

Automated Processes

Streamlining Financial Workflows: ERP automates financial processes, from transaction recording to report generation. This automation minimizes manual intervention, reducing the risk of errors and improving the speed at which financial reports are produced.

Real-time Reporting

Timely Access to Information: ERP systems provide real-time access to financial data, enabling organizations to generate up-to-date reports on-demand. This feature enhances decision-making by providing decision-makers with current and relevant information.

Standardized Reporting Practices

Enforcing Consistency: ERP systems enforce standardized reporting practices across the organization. This consistency ensures that all departments adhere to the same reporting standards, promoting uniformity and compliance.

Adherence to Regulatory Requirements

Built-in Compliance Features: Many ERP systems come equipped with built-in features designed to address regulatory requirements. These features help organizations stay compliant with financial regulations and reduce the risk of non-compliance penalties.

Audit Trail and Documentation

Transparent Transaction History: ERP systems maintain a comprehensive audit trail, documenting each financial transaction from initiation to completion. This transparency aids in audits, ensuring that organizations can provide necessary documentation and comply with auditing standards.

Security Measures

Data Protection: ERP systems implement robust security measures to protect financial data. Access controls, encryption, and authentication mechanisms are integral components that safeguard sensitive financial information, reducing the risk of unauthorized access or data breaches.

Benefits of Using ERP for Financial Reporting and Compliance

Enterprise Resource Planning (ERP) systems offer a range of advantages when it comes to financial reporting and compliance. Here are key benefits categorized into streamlining processes, enhancing accuracy and timeliness, and improving decision-making:

Streamlining Processes

- Efficient Workflow: ERP systems automate financial processes, reducing the need for manual data entry and repetitive tasks. This streamlining of workflows enhances efficiency, minimizes errors, and accelerates the entire financial reporting cycle.

- Unified Platform: ERP provides a centralized platform where financial data from various departments is stored and integrated. This eliminates silos and promotes a cohesive approach to data management, fostering collaboration and communication across the organization.

- Consistency Across Departments: ERP enforces standardized financial practices throughout the organization. This consistency ensures that all departments follow the same procedures, reducing discrepancies and creating a unified approach to financial reporting. Enhanced Communication: ERP facilitates real-time collaboration among different teams involved in financial reporting. This real-time communication ensures that everyone has access to the latest data, fostering better teamwork and coordination.

Enhancing Accuracy and Timeliness

- Data Accuracy: ERP systems provide a single, centralized repository for financial data, minimizing the risk of discrepancies that may arise from using multiple systems. This ensures data accuracy and reduces the likelihood of errors in financial reporting.

- Automation and Real-time Updates: With automated processes and real-time data updates, ERP systems enable organizations to generate financial reports promptly. Timely reporting is crucial for meeting deadlines, making informed decisions, and maintaining compliance with regulatory requirements.

- Comprehensive Documentation: ERP systems maintain a comprehensive audit trail, documenting every financial transaction. This transparency not only facilitates audits but also enhances the accuracy of financial records, providing a clear history of all financial activities.

- Compliance Management: ERP systems often come equipped with features specifically designed for compliance management. By automating compliance checks and incorporating regulatory requirements into workflows, organizations can reduce the risk of non-compliance and associated penalties.

Improving Decision-Making

- Access to Real-time Information: ERP systems provide decision-makers with real-time access to financial data. This enables informed decision-making based on the most up-to-date information, contributing to the overall success and strategic direction of the organization.

- What-if Scenarios: ERP systems allow for scenario analysis by modeling different financial scenarios. Decision-makers can evaluate the potential impact of various decisions on the organization’s financial health, facilitating more strategic and informed choices.

- Performance Analytics: ERP systems offer customizable dashboards with key performance indicators, providing decision-makers with a visual representation of financial performance. This enhances the ability to monitor trends, identify areas for improvement, and make data-driven decisions.

Conclusion

Concludingly, embracing ERP systems for financial management is a transformative strategy that yields streamlined processes, heightened accuracy, and empowered decision-making. The benefits, spanning from process automation to real-time insights, underscore the pivotal role ERP plays in elevating financial reporting and compliance. Organizations stand to thrive in the dynamic landscape with ERP’s comprehensive solutions.

Discover custom ERP solutions for your organization on our website. Explore a detailed overview of how we can assist you with efficient management solutions and more. Feel free to contact us; we look forward to hearing from you today!

All images belong to their respective owners. Please email [email protected] if removal is required.